The Greatest Guide To Hard Money Lenders Oregon

Table of ContentsThe Basic Principles Of Fix And Flip A Biased View of Fix And FlipNot known Details About Hard Money Lenders The Best Strategy To Use For Hard Money LoansNot known Details About Private Money Lenders Some Known Questions About Private Money Loans.

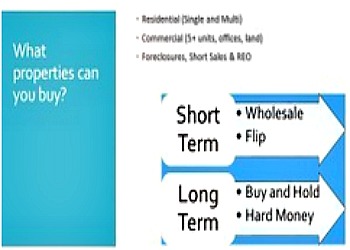

If you back-pedal the funding, you'll lose the property you place forth to secure the finance. There are several alternatives to difficult money loans. If you have a difficult money funding, you could make use of among these to replace it as well:.These lendings are generally utilized in the realty market. Some financiers acquire residences in demand of fixings, repair them up, and after that market them for an earnings. This is recognized as turning and can be difficult to obtain financing for. Various other investor might use hard cash fundings for industrial or rental properties if they can't find traditional funding.

You use them as a fast way to obtain money for an acquisition. Nonetheless, you wouldn't intend to maintain among these fundings for an extended duration because rates of interest for tough money are typically reasonably high. For example, the average passion rate for difficult cash finances in 2020 was 11.

Getting My Commercial Loans To Work

With traditional proportions, lenders understand they can offer your property reasonably swiftly and have a sensible chance of obtaining their money back. Hard money lendings make the a lot of feeling for temporary finances. Fix-and-flip investors are an excellent instance of tough cash individuals: They own a residential property just long enough to boost it, increase the building worth, as well as offer it as soon as they can.

Some Ideas on Private Money Lenders You Need To Know

It may be feasible to make use of tough money to purchase a property that you want to reside in. You could, however you 'd intend to refinance as quickly as you can get a loan with lower rates and a longer car loan term. Hard Money Lenders. To find a tough money car loan, you'll need to contact institutions specializing in this type of transaction.

Difficult money finances are loans broken down by private lending institutions for investment purposes. The rates for these lendings are typically higher, and the terms are much shorter than conventional fundings. The possession you're taking the loan out for becomes the collateral for the lending, so the loan provider's danger is decreased.

Private Money Loans - Truths

The definition of "hard money" when described in actual estate financing, is essentially a financing secured by a possession in contrast to the borrowers financials, credit, and so on. The name difficult cash is regularly swapped with "no-doc", private car loans, bridge fundings, exclusive money car loans, etc, For a difficult money car loan, the underwriting decisions are based on the debtor's tough properties (property).

There are various other sorts of tough cash loans on inventory, equipment, etc but because we focus on genuine estate, we will not go right into these variants here. Considering that the lending institution is not depending on consumers credit score, etc the asset is examined to make sure there is ample collateral to secure the car loan.

Along with calling for significantly more paperwork, standard lenders. Along with needing considerably much more documents, conventional loan providers.

Getting My Precision Capital To Work

Residential small business loan typically take about 45-60 days while we can enclose as low as 5 days. The last crucial differentiator between difficult cash as well as conventional funding is the interest price. Considering that there is even more risk in a real collateral based finance, the interest prices are greater than a traditional home mortgage.

A tough lending is an "possession protected" loan that is given by a private fund or financier. A Difficult Cash loan is a good concept depending on your conditions and goals.

Yes, a difficult money loan provider draws credit rating. On of the primary reasons is to verify identity as well as see if there is anything on the customer's credit report that can influence the loan like a tax obligation lien or reasoning. At Fairview, my key emphasis is not the credit report as we are focusing primarily on the home.

Little Known Questions About Hard Money Lenders.

This must be spelled out clearly in the lending dedication along with the car loan documents/mortgage - over here Private Money Lenders. Due to the speed of closing (5-10 days) most difficult cash lendings are thought about similar to a long term loans money deal. Yes, if a property is noted to buy a tough cash loan provider can give a loan.

When selecting a hard money lender, you require to be mindful. Like any kind of purchase if something sounds too good to be true it most likely is. Concentrate on a regional lender and validate by means of the BBB, google evaluations, as well as googling the company to ensure they are an honest lending institution. Typically, tough money fundings are rate of interest only as they are meant to be made use of for a brief time duration.

For Fairview, we simply need standard property info to start. We finance all our fundings in home and can quickly inform you yes or no on a take care of a quick call or email.